Investire Today | 31 October 2020

The evolution of the financial advisor in 4 steps:

1. From “Promotori” to “Consulenti”, from financial promoters to financial advisors

The change of name to Consulente, or Advisor, does not merely reflect a formal transition – in 2016, the APF (Albo dei promotori finanziari, or Single Register of Financial Promoters) became the OCF (Organismo di vigilanza e tenuta dell’Albo unico dei consulenti finanziari, or Single Register of Financial Advisors); moreover, the supervisory powers were transferred from the Italian Financial Authority (Consob) to the OCF.

The change of name mirrors a change in the characteristics of the profession: the trading skills of the financial advisor as a “seller” have been enriched by the social skills of the financial advisor as a Socratic “maieuta”, someone who, in the exercise of dialogue, incites interlocutors to find the truth within themselves as autonomously as possible. Such dialogic skills, typical of professionals such as psychologists, lawyers and accountants, set them apart from the usual interlocutors of Italian investors.

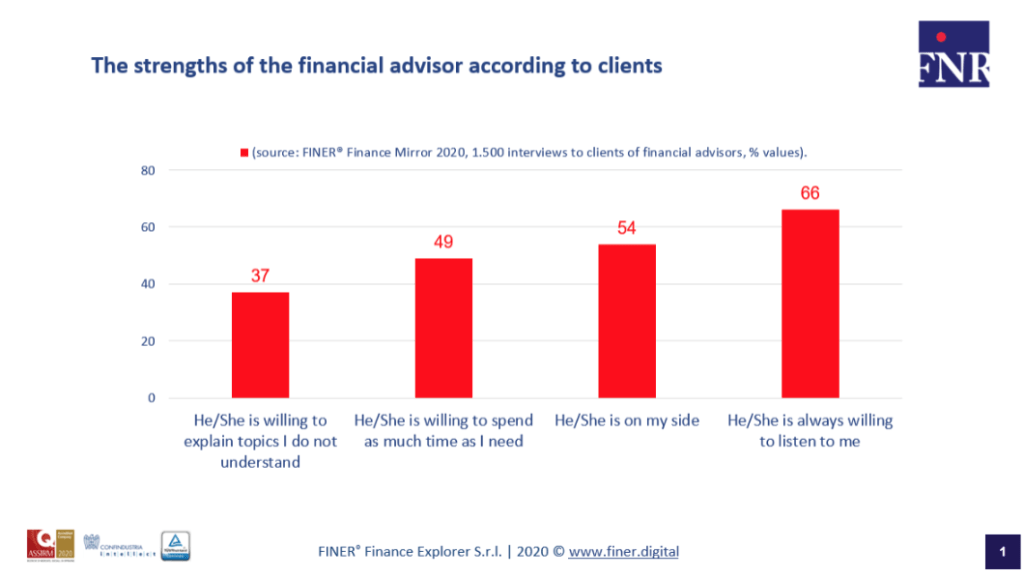

The level of satisfaction among the clients of financial advisors is connected directly to their dialogic skills – among the reasons indicated by clients are “he/she is willing to listen to me” (66%) and “he/she is on my side” (54%).

Moreover, the financial advisor is also a financial educator, a key figure who helps clients making informed choices. Clients appreciate the “time FAs dedicate to them” (49%) and their “propensity to explain subjects they are not aware of or do not understand” (37%) (source: FINER® Finance Mirror, 1.500 interviews to clients of financial advisors).

2. From extra to lead actor

Twenty years ago, many leaders of big banking groups considered financial advisors hard to manage, or less manageable than networks of bank employees.

However, their value did not go unnoticed; in fact, some of the main financial networks of the time were sold – financial networks were considered valuable assets and their management was and still is a job that requires uncommon skills and dedication.

Twenty years later, we can attest to the fact that networks of financial advisors contribute in a significant way to supporting the economic accounts of the same banking groups; moreover, many of them are quickly creating or, in some cases, re-creating financial networks.

3. Four times the assets and double the clients

Over the past twenty years, assets managed by financial advisors have increased fourfold (from 150 to over 600 billion euros, source: ASSORETI). The number of Italian investors assisted by financial advisors has grown from 7% to 15%; over 40% of them are Private Clients and 30% are entrepreneurs (sources: readings by FINER based on ASSORETI data, ANASF, ASSORETI and FINER surveys on end investors).

Lately, financial advisors have gained a primary role in the early stages of business foundation and in the process of generational change. Not bad for someone whose mantra is his/her lack of employments (source: FINER for Anasf Consulentia 2018).

4. Holistic consultancy

In addition to their expertise in asset management, financial advisors need to acquire new skills demanded by the market, in particular in the field of generational change, financial issues linked to inheritance, credit management and protection.

Complementary to all the other themes, protection represents the near future of financial consultancy. Today, the largest share of the component managed by financial advisors (60%) is invested in insurance products. Moreover, recent data suggest that Italians rely on insurance saving, which currently represents 17% of the overall financial wealth of Italian families.

But promoting insurance products is no news for financial advisors. Some of the pioneers of financial consultancy, who used to work for Fideuram, Programma Italia (today Mediolanum) and Dival Ras (today Allianz Bank), gained the recognition of the market thanks to insurance products.

Relationship between financial advisors and networks: from employer to partner

Over the past twenty years, the relationship between financial advisors and financial networks has seen some dark days; however, their marriage seems to be standing the test of time.

Here are some figures (sources: PF Monitor 2000 and FINER® CF Explorer 2020):

- The level of satisfaction towards financial networks has increased: in 2000, only 34% of financial advisors claimed to be fully satisfied; since then, the percentage has grown reaching 46% (+36%) in 2020;

- Strengths of the relationship: in 2019, financial advisors appear more satisfied with their relationship with financial networks, in particular with regard to training (+ 19%);

- Relevant points: over the years, digital media have become increasingly important. Like any F1 driver, financial advisors need competitive vehicles and a competent team; without them, they would not be able to cross the finish line (importance of digital equipment and web collaboration between financial advisors, financial networks and clients, + 340% in 20 years).

Future challenges

Today we are witnessing a global crisis of traditional capitalism and a growth in the value placed on economic and financial sustainability. This requires a substantial change in the paradigm that drives the financial world.

However, the considerable amount of liquidity among Italian and European savers is a clear sign of: 1) an atavistic mistrust of financial markets; 2) managers’ inability to generate value when rates are below zero 3) savers’ inability to manage fears deriving from the volatility of the markets; 4) a very limited time horizon.

The market of financial consultancy and asset management is responding by: 1) looking for alternative solutions (investments in private markets); 2) focusing on sustainable ESG/SRI investments; 3) efficiency and rationalization (investing in digital media, fusion and consolidation of the players); 4) strengthening the clients’ level of trust (support to real economy, charity initiatives).

Today, listening to the market, investing on the skills of financial professionals, optimizing long-distance relations (investments in digital media) and strengthening the trust of clients (transparency and sustainability) have certainly become key factors.

Nicola Ronchetti, Founder & CEO FINER Finance Explorer