Insurance Daily | March 2021

In Italy, over 800 billion euros in real-estate and business assets will undergo a generational renewal in the coming twenty years.

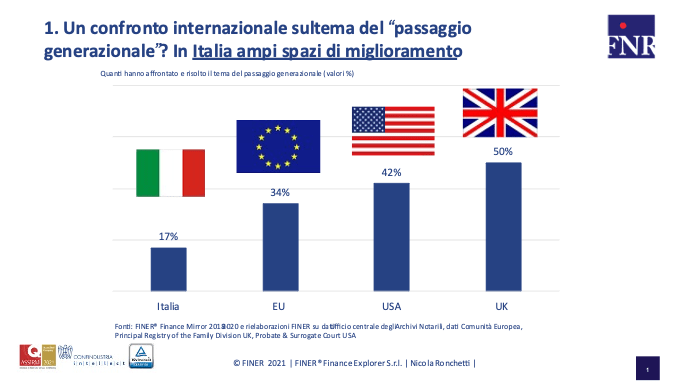

Only 17% of Italians have addressed and solved the issue of generational renewal, compared with a European average of 34%, 42% in the UK and 50% in the USA (diagram 1).

Among entrepreneurs, the figure grows to 55%; however, it is still low if we consider that the average age of Italian entrepreneurs is 68 and is growing every year.

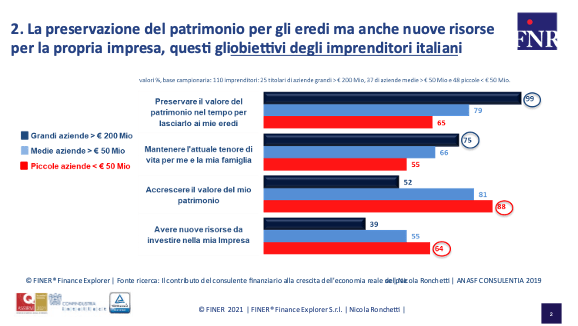

From the standpoint of entrepreneurs, among the aims of generational renewals is not only the preservation of the assets for their heirs, but also the identification of new resources for their companies (diagram 2).

Managing the transfer of the assets early, in an efficient and organized manner, is a determining factor for the development of liquid and illiquid assets.

The process of generational renewal is complex, and many entrepreneurs refuse to address it. In fact, it can be quite an upsetting moment, as its economic-financial dimension often joins old relational and family dynamics.

The generational shift has to be faced with family, assets and company in mind. It should not be seen as an event, but as a gradual process made of a series of stages. The first stage should be planning.

Only from this perspective can the generational renewal become an opportunity for growth rather than a time of crisis.

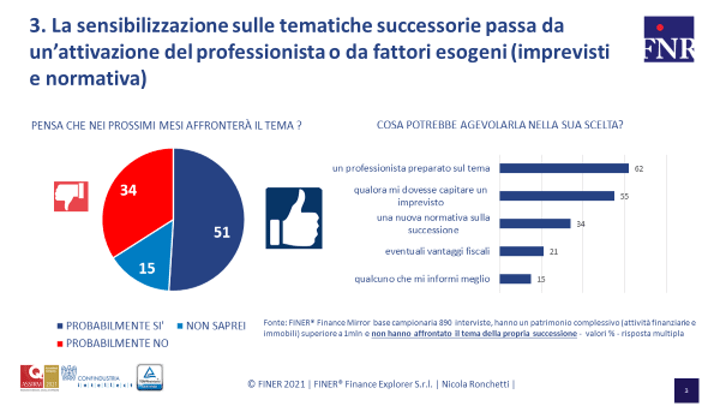

Outside experts are often responsible for raising awareness on succession issues (diagram 4). They are able to ensure a neutral and objective approach to the identification of management, financial and asset protection solutions.

Therefore, accountants, notaries, financial advisors, private bankers, agents and insurance brokers have a great opportunity, but also the social responsibility of contributing to ensure the business continuity of their clients.

Nicola Ronchetti