Investire | July 2020

There is a kind of finance which goes short on listed companies and that is commonly described as speculative; its motto is mors tua vita mea.

There is, however, another kind of finance which invests in companies adopting a medium-long term sustainable strategy.

Even before the pandemic, finance was moving in a clear direction, well described by Larry Finch’s words: “We are on the edge of a fundamental reshaping of finance. The evidence on climate risk is compelling investors to reassess core assumptions about modern finance”.

The new option offered by the industry of asset management seems quite praiseworthy: in an age characterized by rates below zero and money anchored to liquidity, the industry of asset management offers illiquid investments associated with infrastructures and with the assets of non-listed businesses.

But, how can such investment products, usually destined to a select few, reach a wider audience of Italian end investors?

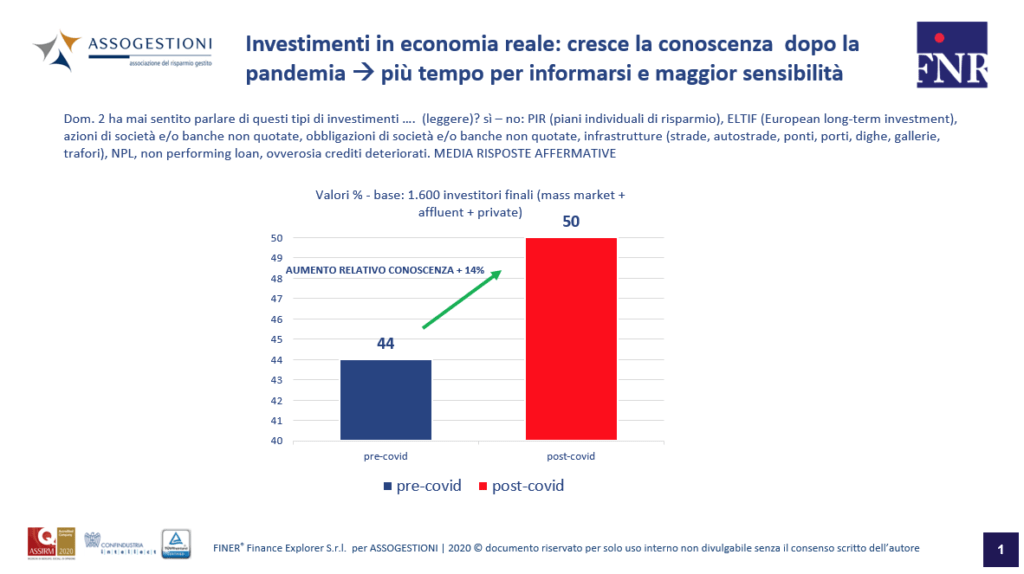

In order to answer the question, FINER carried out a research on behalf of ASSOGESTIONI involving 1.600 end investors and 1.100 financial professionals (financial advisors, private bankers, bank managers and fund selectors).

The research was carries out over two periods of time: before the Covid-19 emergency, 27 January – 17 February 2020; and after the Covid-19 emergency, 18 – 26 May 2020.

The research highlights the presence of a potential market segment. While vast and qualified, it must be informed, educated and developed.

Moreover, data reveal an increase in the level of awareness (+14%) and interest (+13%) for investments in real economy among end investors after the pandemic. Indeed, the lockdown has increased end investors’ cognizance – because they had more time to find information – and sensitivity, having experienced an unprecedented sense of vulnerability.

Everyone agrees in saying that such investments may help the country to get back on its feet. As a consequence, the interest in investments in infrastructures and Italian companies with measurable social and environmental impact is growing.

Financial professionals – i.e. financial advisors, private bankers and bank clerks – are convinced that investments in real economy can contribute to the relaunch of the country; however, they underestimate (of 17%) the increase in the level of interest as well as their clients’ willingness to subscribe such investment products.

Therefore, the launch of illiquid products depends on the ability of the distribution system and of the AMCs to provide end investors with an adequate level of information and awareness. That, at least, is the opinion shared by fund selectors: acting as mediators between distribution system and managers, they seem to be aware of the discrepancy between supply and demand and wish for a more proactive role mostly on the part of the distribution system.

According to fund selectors, 85% of end investors are not familiar with illiquid investment products; the task of informing them is in the hands of contact people (100%), banks (99%) and, partially, AMCs (66%).

Ultimately, these premises and figures suggest that the industry of asset management may be able to contribute to real economy, thus helping the country to get back on its feet.

Within a market strongly driven by supply and demand, the responsibility is now in the hands of the distribution system and of financial professionals – financial advisors, private bankers and bank operators. All we can say is, strike while the iron’s hot.