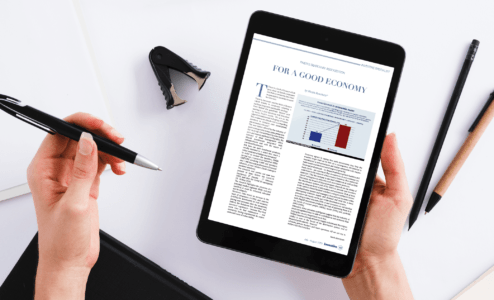

BANKS AND NETWORKS: PASSING THE BATON

Investire | June 2025 If until a few decades ago it was unthinkable that over 40% of private clients (with financial assets exceeding a few million euros) would rely on a financial advisor, today it is a reality. There are essentially two reasons for this

Read more...